There are seemingly hundreds of travel-related credit cards where users receive benefits, like points for free flights, hotels, restaurants, etc. I have the Delta Platinum American Express card and rarely use it because I get enough miles by traveling frequently (and, to be honest, they were having a sign-up special where you received 70,000 miles, which I used up in the first year for upgrades. It definitely came in handy). When Uber announced it was debuting a Visa card with Barclay, I didn’t really pay attention. Again, there are so many travel-related credit cards in an already crowded space.

Chillin out with Uber.

I was fortunate to celebrate the launch of Uber’s new Visa Card in Los Angeles last month, and I saw the card in action. Initially, I couldn’t understand why card benefits felt so random but now I know Uber is trying to prove they are more than a ride from Point A to Point B; they want to tap into the user’s lifestyle (like AirBnb with it’s “community”), and it’s SMART. This is why Uber Visa Card is not what I expected…. and why it will be successful.

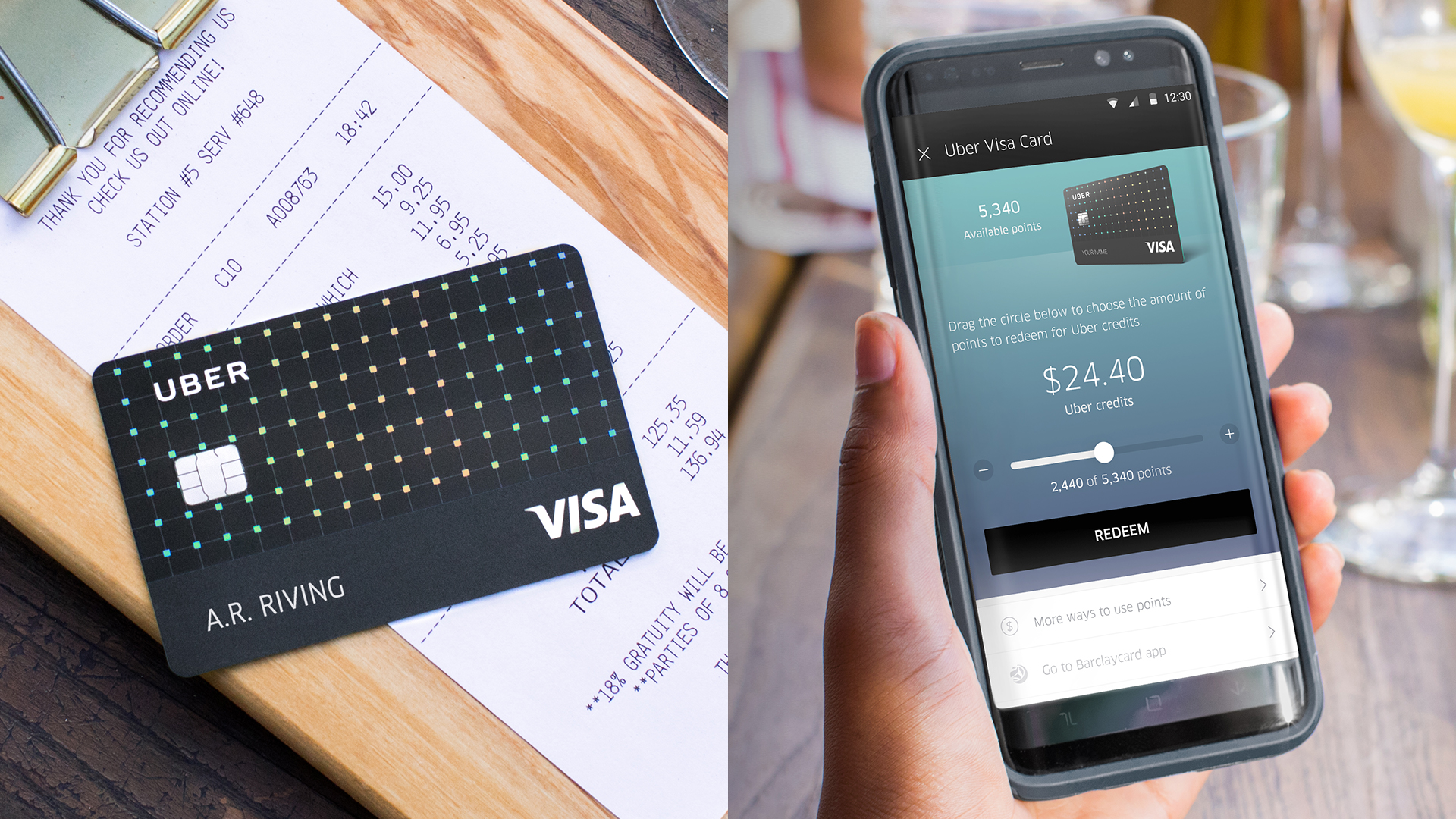

The new Uber Visa card.

5 reasons why you’re getting Uber’s new credit card!!

1. The “lifestyle” approach. Uber going for the “lifestyle” jugular is smart as any marketer will agree. It wants to say ‘we’re not just an app on your phone; we are human too and hell yeah we can be cool.’ Like the AirBnbs and JetSmarters and SoHo Houses of the world, Uber is making great strides to connect with its customers, foster a community and build a brand image with faces, rather than a Smartphone icon. Obviously no one is going to run out and buy an Uber dress if that’s made, but they will say “Oh hey, I went to Coachella where Uber did a free pool party and it was actually awesome.” We use Uber in our every day lives, and the rideshare app wants to be known more than a rideshare app. From a marketing perspective, this works.

2. The credit card benefits. I have to stress that the benefits here are FANTASTIC, and there are many, so let’s bulletpoint the main ones:

1. NO ANNUAL FEE. How insane is that?

2. 4% back on restaurants, takeout, bars AND UberEATS. If you order UberEATS as much as I do, the 4% back basically equates to free deliveries every month.

3. 3% back on airfare, hotels and vacation home rentals. Yes, you’ll get money back from all your travels.

4. 2% back on online purchases, including Uber, online shopping, video and music streaming services. 1% back on all other purchases.

5. Mobile phone insurance of up to $600. No, SERIOUSLY. This includes damage and theft, so if you lose your phone in an Uber, you’re all set. You do have to use the card to pay your monthly phone bill but that’s not really a “catch” because you’re racking up points for this.

A breakdown of the rewards.

3. Real-time access to points and Uber credit instantly. Because your card is integrated in your Uber app, you can use rewards redemption immediately (even if you don’t have the physical card on you). Obviously, the more you use the card for shopping, etc, the more points you accumulate that can go into Uber credit. Not all credit cards are instant like this (for instance, say, my Delta AmEx. I had to wait two months for that 70K mile deposit).

4. The 4% back on restaurants, takeout, bars and UberEATS is pretty insane. Let’s talk about this for a second. That’s 4% back on dining… for a RIDE-SHARE APP. WTF, right? No, it goes back to the lifestyle approach, where Uber wants their users to go out with their friends (via Uber, of course), have a blast, get home safe and even get money back while they do this. Also, if you order UberEATS as much as I do, you’re literally saving money by connecting the Uber Visa Card as payment, rather than your debit card (I get nada points for my debit!). If you eat out often (or, uh… drink often), you get rewarded for it.

5. It is brainless. Seriously. Not only is there no annual fee, you literally get paid* for using it (*as in cash back on literally almost anything). You don’t even have to leave your house. UberEATS delivers to your home, and you get 4% back on every purchase. THIS IS BRAINLESS, folks. If you spend an average of $100 a week (like I do), you are getting $4 back that week, which is basically getting one UberEats without the delivery fee, every week. That’s just a tiny example of how much you’ll get back.

This is how it works. Seamless, right?

Jimmy Im has traveled to 113 countries, stayed at over 600 hotels and clocked millions of air miles. He currently lives in New York City.